The flexible workspace industry has exploded, evolving from a niche trend for freelancers into a standard requirement for Fortune 500 companies. For entrepreneurs and landlords looking to enter this market, the biggest question is often: Should I build my own brand, or buy a franchise?

This guide covers everything you need to know about coworking franchises—from the economics and the trade-offs to the hard questions you must ask before signing a contract—and introduces a modern alternative that might save you six figures in upfront costs. Also see our guide on how to start a coworking space.

What Is A Coworking Franchise?

A coworking franchise is a business model where an investor (the franchisee) pays an initial fee and ongoing royalties to a parent company (the franchisor) in exchange for the rights to use their established brand, operational systems, and proprietary technology.

Think of it as buying a "business in a box." Instead of spending 18 months figuring out your own floor plans, Wi-Fi architecture, access control systems, and legal contracts, you are handed a turnkey blueprint for success.

In this relationship, the franchisor provides the brand recognition and the playbook, while you provide the capital and the day-to-day management. It is the fastest route to opening a flexible workspace, designed to minimize the risks of starting a business from scratch—but it comes at the cost of monthly royalty fees and strict adherence to corporate rules.

The Core Trade-Off: Autonomy vs. Acceleration

The decision to franchise isn't just about money; it's about your identity as an entrepreneur. You are trading total control for speed and support.

The Pros (Why Buy a Franchise?)

The "Plug-and-Play" Launch:

You skip the steep learning curve of figuring out tech stacks, furniture sourcing, and interior design. Franchisors provide vetted vendors and architectural blueprints, allowing you to open months faster than an independent operator.

Brand Trust & Corporate Contracts:

Major franchises (like Venture X or Office Evolution) often have national accounts. You might open your doors with revenue already on the books from enterprise clients who need satellite offices for their remote teams.

Purchasing Power:

You get bulk pricing on furniture (e.g., Herman Miller, Steelcase), software, and insurance that an independent operator could never negotiate alone.

Financing Credibility:

Banks and SBA lenders are significantly more likely to approve a loan for a known franchise brand with a low default rate than for an unproven independent concept.

Operational Support:

You have a dedicated support team for when—not if—things go wrong. Whether it's a billing software crash or a marketing slump, you aren't solving it alone.

The Cons (The "Gotchas")

High Initial CapEx:

Franchise fees ($40k–$80k) are just the entry ticket. You are also often mandated to use specific, expensive vendors for build-outs, meaning you can't "DIY" or value-engineer your construction costs as easily as an indie owner.

Royalty Fees:

You will pay 6%–8% of your gross revenue (not profit) to the franchisor every month. In low-margin months, this can be the difference between breaking even and losing money.

Rigid Branding:

If your local market screams for a podcast studio but headquarters mandates a standard conference room layout, you often have to follow HQ. You lack the agility to pivot quickly based on local trends.

Territory Restrictions:

You are often locked into a specific zone. If a great building opens up 5 miles away but it's in another franchisee's territory, you can't touch it.

The Economics: What It Really Costs

Coworking is an asset-heavy business. Understanding the financial reality before you sign is critical.

Total Investment: $200k – $2M+ (depending heavily on square footage and location).

- Low End: Converting an existing office space with minimal demolition.

- High End: Shell condition retail space requiring full HVAC, plumbing, and glass wall installation.

The "J-Curve" Reality:

Coworking is not a get-rich-quick scheme. It is a "J-Curve" business. Expect to lose money for the first 12–18 months while you fill occupancy. Franchisors often sell the "dream" of 90% occupancy, but reaching that takes aggressive local sales efforts.

Hidden Costs:

- Marketing Fund: Usually 1-2% of revenue goes into a national ad fund.

- Technology Fees: Mandatory monthly fees for their proprietary app/portal.

- Refresh Mandates: Contracts often require you to update furniture/decor every 5–7 years at your own expense to maintain brand standards.

The Alternative: The DropDesk Landlord Partnership

For many landlords and investors, the "Franchise Tax" (high fees, strict rules) outweighs the benefits. This is why we introduced the DropDesk Landlord Partnership—a model designed to give you the infrastructure of a major brand without the handcuffs.

We provide the "business in a box" technology and marketing support, but you keep your autonomy and your margin.

1. Low Barrier to Entry (No $50k Franchise Fee)

Traditional franchises charge massive upfront fees just for the right to use their logo. DropDesk partners can launch their flexible space strategy with significantly lower upfront capital. We focus on monetizing your existing assets, not forcing you to build a cookie-cutter office.

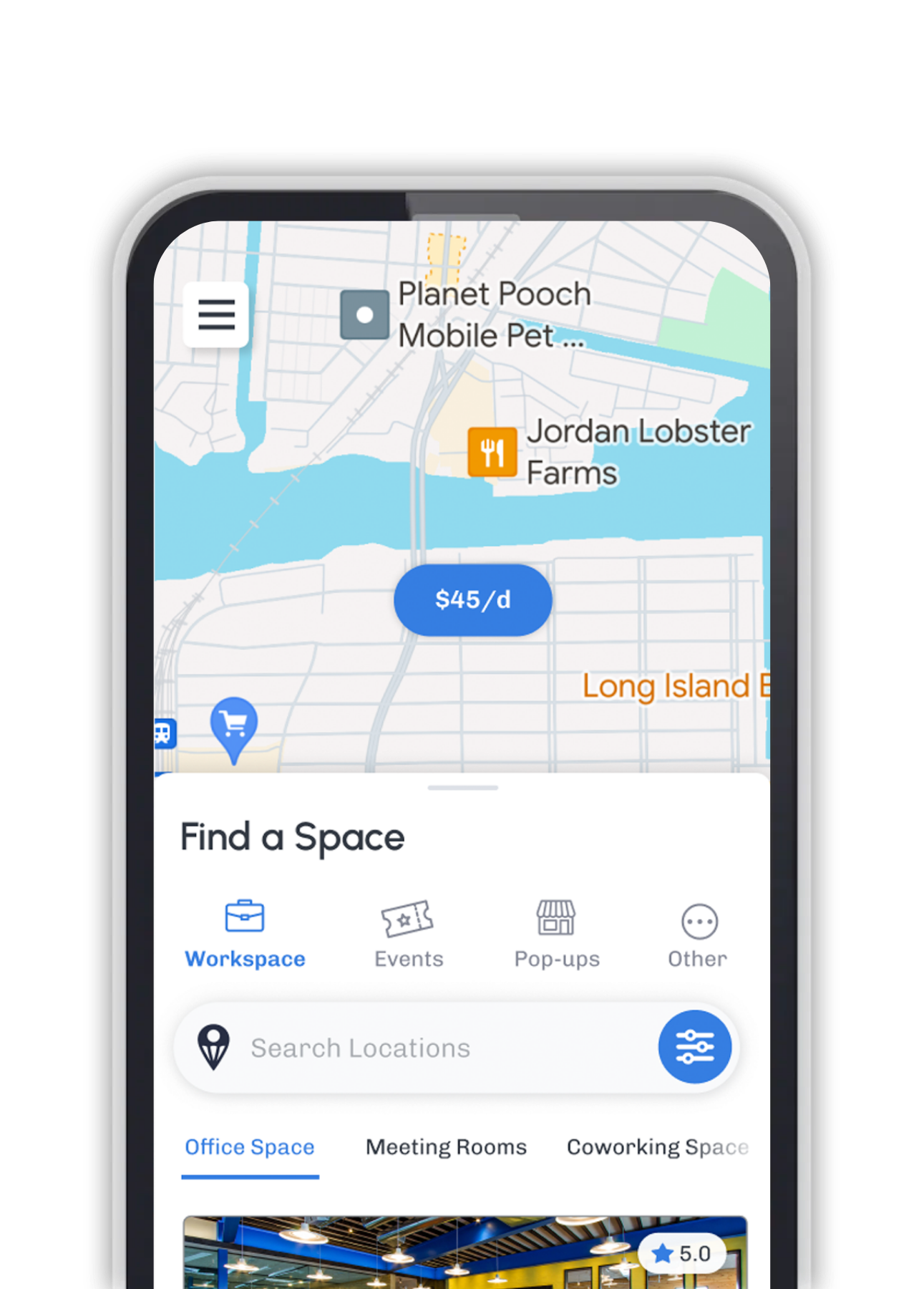

2. Your Brand, Our Infrastructure (White-Label)

With a franchise, you are building their brand equity, not yours. With DropDesk, you get a white-labeled management platform. Your tenants see your logo on the app, your colors on the portal, and your name on the door—powered by our backend technology.

3. Performance-Based Growth

Franchises often charge royalties on gross revenue, meaning you pay them even if you are losing money. DropDesk operates on a model aligned with your success. We provide the automated CRM, billing systems, and booking engine you need to run efficiently, and we help drive revenue through our marketplace.

4. Marketing That Actually Fills Desks

Instead of paying into a vague "National Ad Fund," DropDesk partners get access to local SEO, paid ads management, and pre-built sales funnels specifically designed to capture leads in your zip code. Our internal marketing team works to outrank your local competition, driving inquiries directly to your CRM.

The "Must-Ask" Questions Before Signing a Franchise Agreement

If you are still considering a traditional franchise, do not sign a Franchise Disclosure Document (FDD) until you have received clear, written answers to these questions.

1. Financial Due Diligence

"Does your Item 19 show Net Profit or just Gross Revenue?"

Why: Many franchisors only disclose "Gross Sales" because it looks impressive. You need to know the Net Profit (EBITDA) to see what owners actually take home.

"What is the average 'Time to Break-Even'?"

Why: You need to know if you should have 6 months of working capital in the bank or 18 months.

"Are vendor mandates price-competitive?"

Why: Ask if approved vendors offer franchisee discounts or if they are actually more expensive than sourcing locally due to kickbacks the franchisor receives.

2. Operational & Marketing Support

"Do you provide actual leads, or just 'brand awareness'?"

Why: There is a huge difference between a franchisor running national TV ads and one sending qualified leads to your inbox. If they take a 2% Marketing Fund fee, ask exactly what deliverables you get.

"Is the technology proprietary or white-labeled?"

Why: If their "proprietary software" is just a reskinned version of a generic tool you could buy yourself, you aren't getting value for your tech fees.

3. Territory & Competition

"Does my protected territory include 'Corporate' locations?"

Why: Some contracts prevent other franchisees from opening near you but allow the parent company to open a corporate-owned location right across the street.

"How do you handle 'National Accounts' revenue?"

Why: If the franchisor signs a deal with Amazon globally, do you get that revenue if those employees use your location? Or does corporate keep it?

4. The Validation Call (The Most Important Step)

"Can I speak to a franchisee who opened in the last 12 months?"

Why: Don't just talk to the "star" franchisees the sales rep introduces you to. Look up owners who opened recently and ask: "Knowing what you know now, would you sign this agreement again?"

Conclusion

Buying a coworking franchise can be an accelerator, but it is not a passive investment. It requires capital, patience, and a willingness to follow a strict playbook.

For landlords who want the technology, operational guidance, and marketing power of a franchise—without the six-figure fees and loss of control—the DropDesk Landlord Partnership offers a modern alternative. Whether you want to launch a coworking space, a creative studio, or a hybrid office, we give you the tools to re-imagine your space and be significantly more profitable.

Philip Beck

Seasoned serial entrepreneur, board member and C‑level executive with over 25 years' experience founding and scaling technology and payment businesses across the Americas, Asia Pacific, Europe and the Middle East. Combines an international legal background with deep domain expertise in electronic payments, identity management and shared‑economy platforms to drive strategic growth, IPOs and M&A transactions.